Pre-Tax vs Roth: The Real Math Behind Paying Taxes Now or Later

Learn the simple math and logic behind when to pay taxes — now or later — and why the real key to building wealth isn’t guessing tax rates, but creating flexibility with pre-tax and Roth strategies.

Navigating Elevated Interest Rates: Debt Strategies That Work for Small Businesses

In a “higher for longer” interest rate environment, smart business owners aren’t waiting for cheaper money—they’re engineering resilience by restructuring debt, optimizing loan terms, and managing capital with precision.

Why Business Owners Don’t Have a Money Problem—They Have a Peace Problem

What’s money really for—freedom, time, peace…or just avoiding boredom?

Health Insurance Subsidy Cliff Returns in 2026: How ARPA’s Expiration and Your MAGI Will Impact Premium Tax Credits

When ARPA’s temporary subsidy relief ends in 2026, many families could see their health insurance premiums jump by thousands overnight—unless they understand how to manage their MAGI.

Municipal Bonds, U.S. Treasuries, and International Bonds: How to Build a Balanced Fixed Income Portfolio

Thoughtful bond allocation—balancing duration, municipal vs. taxable, and U.S. vs. international exposure—can dramatically improve returns and reduce risk, as one investor learned after losing 1.2% annually by getting it wrong.

2025 Student Loan Shake-Up: SAVE Plan Lawsuit, New RAP Repayment Rules & Major Borrowing Caps for Future Students

Major changes to student loans are here—this post breaks down everything you need to know about the SAVE plan lawsuit, new RAP repayment rules, and strict borrowing caps that could reshape how college is funded.

Breaking Down Trump’s ‘One Big Beautiful Bill’: 2025 Tax Cuts, Deductions, and Wealth Planning Moves

Trump’s 2025 Tax Reform Bill extends key TCJA provisions, introduces new deductions, expands estate and gift exemptions, phases out clean energy credits, and creates fresh planning opportunities for small business owners, high earners, and families through 2026 and beyond.

How to Maximize Your QBI Deduction with Trump’s New Tax Bill: The 28.57% S-Corp Salary Strategy Explained

Unlock massive tax savings under Trump’s new bill by learning how a precise 28.57% S-corp salary strategy can supercharge your QBI deduction and keep more money in your pocket.

From Founder to Architect: The Leverage Framework That Builds Legacy Businesses

Discover how 7–8 figure business owners scale smarter by combining leverage—labor, capital, code, and content—with strategic judgment, specific knowledge, and long-term thinking to build a business that grows without them.

Why Loading Up on Short-Term Bonds in an Inverted Yield Curve Could Hurt Your Returns

Think twice before going all-in on short-term bonds in an inverted yield curve—understand why total return, tax efficiency, and time horizon matter far more than chasing today’s highest yield.

2025 Tax Law Changes: What the New Proposed Bill Means for Your Income, Deductions, and Planning Strategies

A sweeping new tax proposal could reshape your income, deductions, and estate strategy—here’s what’s on the table as Congress eyes a July 4th vote.

Should Married Couples Use a Joint Trust or Two Separate Trusts?

Discover how choosing the right trust structure—joint or individual—can protect your wealth, reduce taxes, and ensure your legacy reaches the people you love most.

How to Build a Smarter Fixed Income Portfolio: Boost Returns, Lower Risk, and Beat Inflation

Discover how a smarter fixed income strategy — grounded in academic research and real-world application — can maximize your portfolio’s stability and returns without taking unnecessary risk.

Stock Market Volatility: Why Short-Term Drops Are the Price of Long-Term Wealth

Market drops like this week's 13% dip can rattle investors, but understanding why volatility is the cost of long-term wealth is key to building a resilient portfolio and staying the course when others can't.

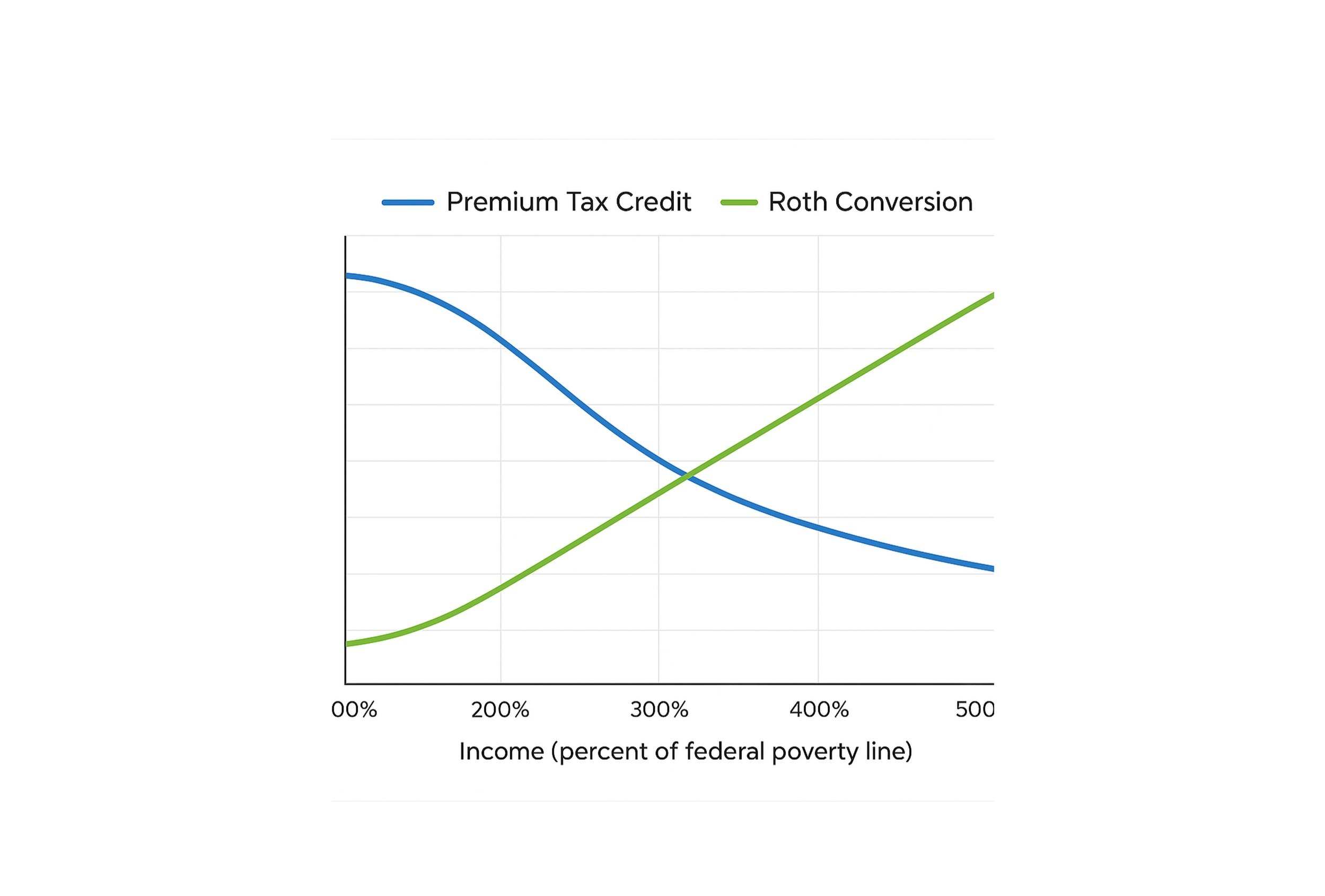

Early Retirement Health Insurance Strategy: Cash Withdrawals vs. Roth Conversions for PTC Optimization

Should you minimize income to maximize the Premium Tax Credit or leverage Roth conversions for long-term tax savings? Here's how early retirees can strategically balance both to reduce healthcare costs and lifetime taxes.

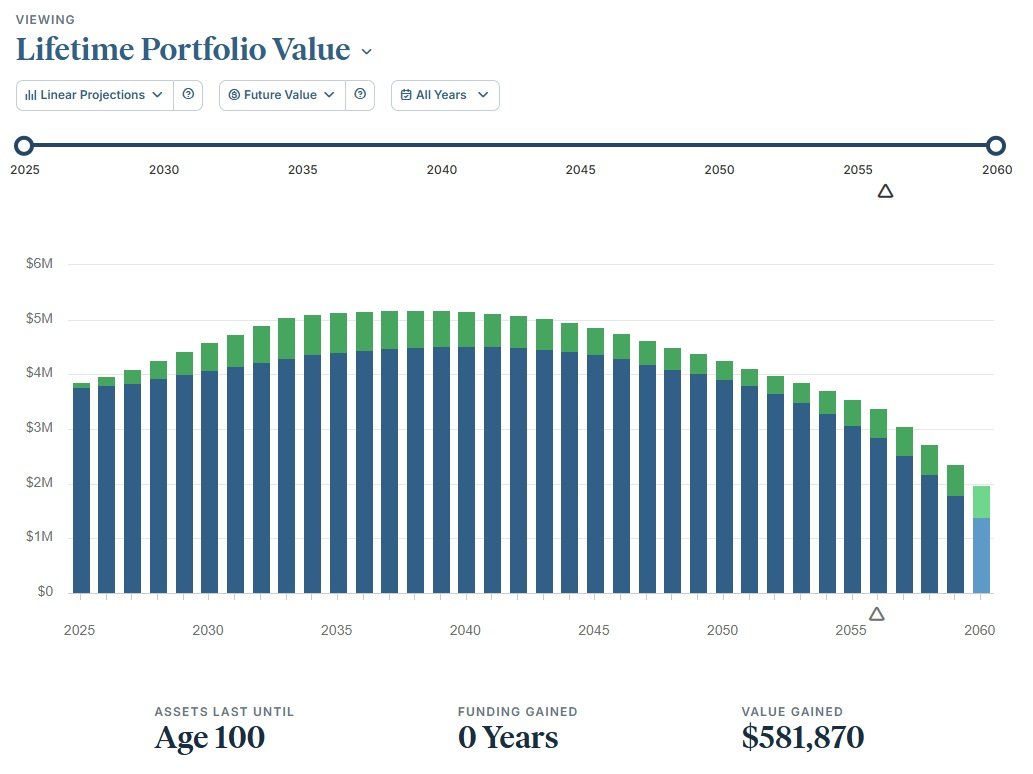

Retirement Income Planning: Why Smart Withdrawal Strategies Matter More Than Savings

Retirement success isn’t just about how much you’ve saved—it’s about how strategically you withdraw, and new research suggests that dynamic withdrawal strategies could significantly extend your portfolio’s longevity and increase your lifetime spending.

The Truth About the Size Premium: Why It Still Exists If You Control for Quality

The small-cap premium isn’t dead—it thrives when you control for quality, as research shows that high-profitability small-cap value stocks significantly outperform their low-quality counterparts, offering a compelling case for strategic factor-based investing.

The One Business Risk You’re Ignoring: Why Every Owner Needs a Buy-Sell Agreement (Before It’s Too Late)

Most business owners take time for vacation, but few spend time securing their business with a buy/sell agreement—here’s why delaying this critical step could cost you everything.

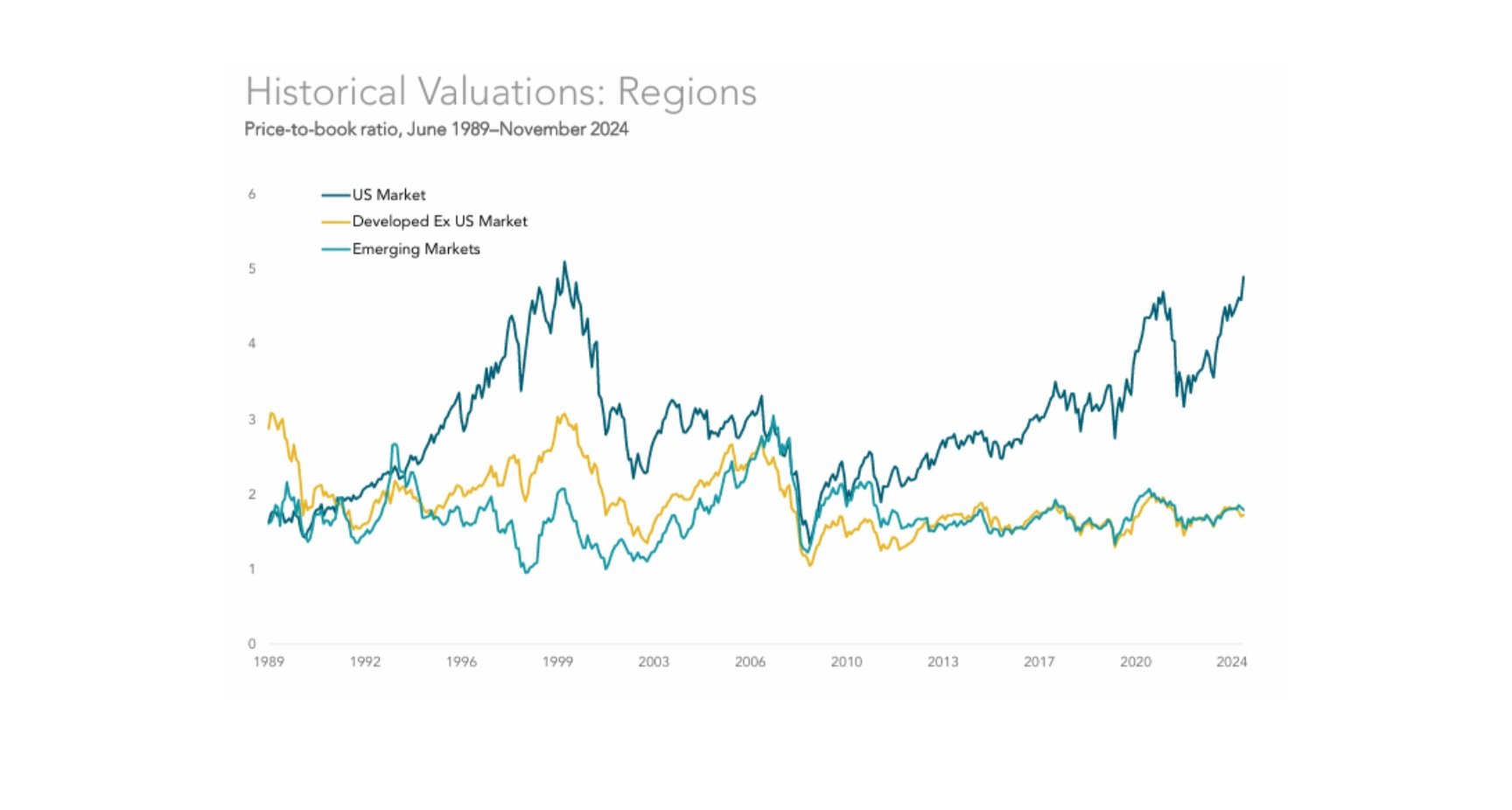

The Illusion of S&P 500 Outperformance: Why Smart Investors Think Bigger

Relying on the S&P 500 as your sole benchmark for investment success is like judging a restaurant only by its dessert—this article uncovers why true long-term investing requires diversification, discipline, and a global perspective beyond today’s market winners.

How I Helped a Business Owner Save Over $60,000 on Health Insurance Costs Without Cutting Employee Benefits

Discover how I helped a small business owner save over $60,000 annually on health insurance by leveraging the healthcare marketplace and premium tax credits—without sacrificing employee benefits.