How to Maximize Your QBI Deduction with Trump’s New Tax Bill: The 28.57% S-Corp Salary Strategy Explained

Trumps Big Beautiful Bill got signed into law on July 4th - which extended the majority of what would otherwise have been expired tax legislation.

The qualified business income (QBI) deduction is one of the extended pieces of tax legislation.

The short & sweet of QBI is it allows eligible taxpayers to deduct up to 20% of their qualified business income from a pass through entity (s-corp, sole prop/LLC, or partnership).

What’s unique here is that when you’re an s-corp owner, there’s a 28.57% formula that allows you to determine a salary that will maximize your QBI deduction.

More on this later, but first, let’s better understand what QBI is in the first place.

That 20% is calculated by taking the lessor of:

20% QBI plus 20% of qualified REIT dividends and publicly traded partnership income

20% QBI minus net capital gain

But the QBI deduction phases out if your business income in 2025 exceeds $383,900 for married filing joint or $191,950 for single individuals.

If you’re below the phaseout thresholds, you’re good to use the full 20%.

If you’re above the phaseout thresholds, there’s additional limitations.

Those limitations for those over the threshold, the QBI deduction is limited to the lessor of:

20% QBI or

The greater of:

50% of W2 wages paid by the business, or:

25% of W2 wages plus 2.5% of unadjusted basis of qualified property.

There’s another kicker here that if you’re considered a specified service trade or business (SSTB), those businesses are health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, or any trade of business where the principal assets is the reputation or skill of one or more employees/owners, then you enter another phaseout. In 2025, that is:

Married filing jointly: $383,900 - $483,900

Single: $191,950 - $241,950

Once you’re over the top end of the phaseout, you don’t get to benefit from the QBI deduction at all.

Now back to this 28.57% formula you can use to determine a salary number for yourself that will maximize your QBI deduction.

This comes from dividing 2 by 7 which signifies the perfect balance between W2 wages and business income.

Let’s unpack this.

If you’re over the QBI phaseout threshold and have no significant qualified property, your deduction is limited to 50% of W2 wages.

To fully utilize the 20% QBI deduction your business needs to pay enough W2 wages to support the deduction.

The maximization comes from the idea that if we set:

20% of QBI = 50% of wages

Then solve for W2:

W2 wages = 40% of QBI (20%/50%)

But if QBI is your business profit after W2 wages, then we need to express this in terms of total business profit (before paying yourself out), we place W2 wages with:

Total profit = QBI + (total profit - W2 wages)

So as we solve this we see:

W2 wages = .4 * Total profit - .4 * W2 wages

1.4 * W2 wages = .4 * total profit

W2 wages / total profit = .4 / 1.4 = 2/7 or 28.57%

What this tells us is that about 28.57% of total business profit paid as W2 wages is the sweet spot to maximize your QBI deduction without paying unnecessarily high payroll taxes (FICA taxes which is 15.3% social security and medicare tax).

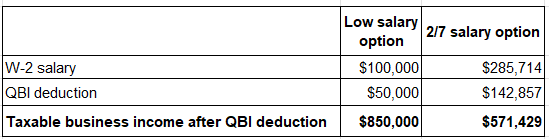

I recently met with a business owner in the phaseout of QBI where we did this work. Let’s see how this played out:

And just like that, this business owner was able to unlock a nearly 3x increase in their QBI deduction. This is a great way to unlock more tax savings when applied appropriately.