Health Insurance Subsidy Cliff Returns in 2026: How ARPA’s Expiration and Your MAGI Will Impact Premium Tax Credits

Anyone who has health insurance from the healthcare exchange could be in for a surprise starting in January of 2026.

As part of the COVID relief the $1.9T American Rescue Plan Act (ARPA) that was passed in 2021 removed the 400% of the federal poverty guideline and capped the subsidy at 8.5% of household MAGI.

This meant that higher-income individuals could qualify for the credit.

How this worked prior to the ARPA being passed, if someone had income 100% or less of the federal poverty guideline based on family size, they could have the full amount of the premium subsidized.

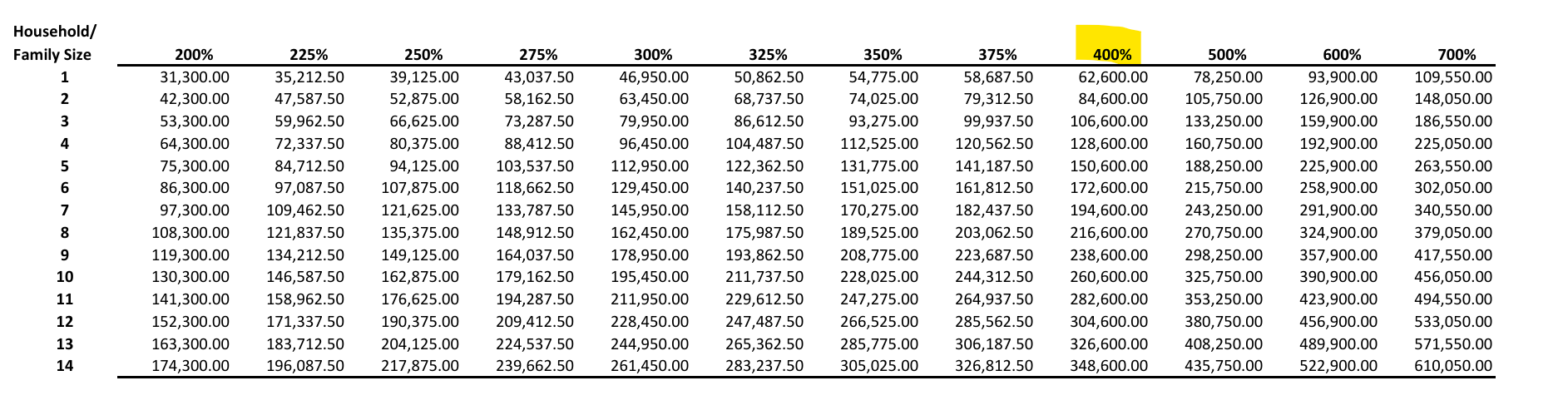

As income continues to grow, that subsidy amount gets pulled back until you hit 400% of the federal poverty guideline and the benefit fully falls off - also known as the subsidy “cliff”.

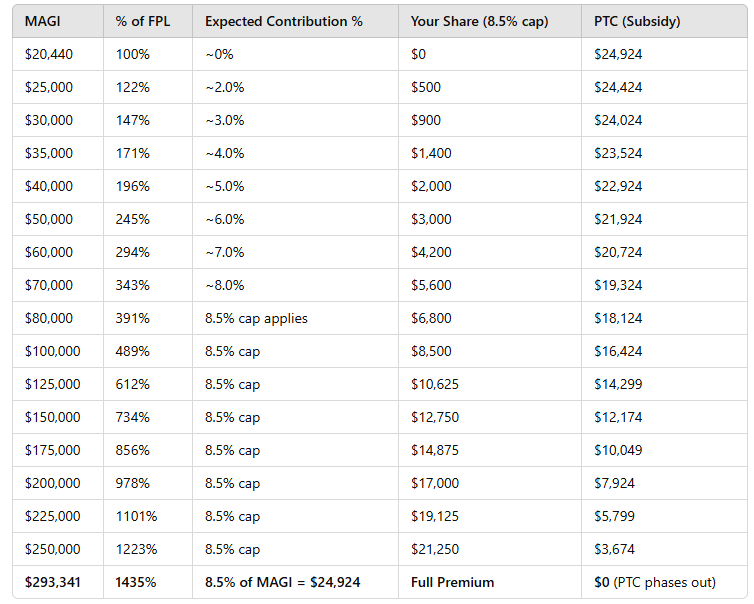

The premium tax credit amount is based on the cost of the 2nd lowest silver plan in the marketplace, so depending on where you live, your age, and your family size the subsidy amount varied.

For some individuals the subsidy at 399% of the federal poverty guideline was a few thousand dollars.

Reaching 400% of the federal poverty guideline was a big deal - meaning, loss of potentially thousands of dollars in subsidy amount.

When the ARPA was passed, the 400% of the federal poverty guideline was replaced with an 8.5% of household modified adjusted gross income cap.

This meant that higher-income individuals could qualify for a subsidy amount.

As income continues to grow, that subsidy amount gets pulled back.

This temporary benefit is eliminated at the end of this year, meaning, on January 1st, 2026 the premium tax credit returns back to its 400% of the federal poverty guideline and many individuals and families getting this credit amount will likely be shocked with a significantly higher premium.

The question is what can you do about it?

I see there really being two options.

One option is to accept it.

The other option is to work to lower your MAGI to be within 400% of the federal poverty guideline.

For those who choose option one, you can stop reading now.

For those who choose option two, below is some options to reduce your MAGI:

Utilize your employer retirement plan or savings vehicles that allow for tax deferral (401k, 403b, TSP, 457, IRA, etc.) for the 401k/TSP/403b/457 list, the max contribution if you’re under 50 is $23,500 in 2025, if you’re over 50 you get an additional $7,500 catch up contribution.

Your health savings account (if eligible) is another great tool to save tax deferred at $4,550 for a individual or $8,550 for a family plan

Trump’s one big beautiful bill that was passed on July 4th creates unique opportunities. I wrote about that earlier HERE.

Utilizing as much above the line contributions as possible such as the deductible portion of self-employment tax, self-employed health insurance premiums, student loan interest, pre-2019 alimony, educator expenses, and Qualified Charitable Distributions (QCDs) for those over 70½.

The main thing here is going to be not earning income above 400% of the federal poverty guideline.

For some who can control their level of taxable income (such as retirees with flexible spending patterns and/or large brokerage accounts with high basis that can allow for larger distributions to be made but less tax is owed) or business owners (who can accelerate asset purchases and utilize depreciation to offset some of their profit) being at or below 400% of the federal poverty guideline becomes possible to obtain.

On the other hand, this will just be out of reach for many who were previously eligible.

There’s only so much you can do as a W2 employee. You may have the ability to shift 25% of income around with the tax planning tools noted above but after that - anyone over the income threshold will experience the cliff in premium tax credit.

When the ARPA provisions expire in 2026, many households will face higher health insurance premiums as the 400% federal poverty guideline “cliff” returns. The difference of just a few dollars in income could mean losing thousands in subsidies.

For some, staying under the threshold is realistic through retirement planning strategies, HSAs, and other above-the-line deductions. For others, particularly W-2 earners with limited flexibility, the cliff may simply be unavoidable.

The key takeaway is awareness—understanding how your Modified Adjusted Gross Income is calculated and how it impacts your eligibility can help you make informed decisions. While not every household will be able to fully avoid the subsidy loss, those who plan ahead will be in the best position to minimize the impact.