Should Married Couples Use a Joint Trust or Two Separate Trusts?

Should your family’s legacy live within one trust or two?

When it comes time to draft estate planning documents, a common question I hear is about whether it makes sense to have joint or individual trusts.

Trusts are an unique planning tool that can help provide:

Increased control over the distribution of your assets when you pass.

Avoid the cost of probate, saving time, future headache, and fees.

As with most personal financial decisions - they’re more personal than finance so in this case, you should consider your personal plan to decide what makes the most sense for you.

It’s important to note as well that your desires and circumstances will change - and so should your estate plan.

The best thing you can do in life is have an estate plan that you amend many times - because it means you’re here to deal with it.

The worst thing you can do is put off your estate plan while waiting for some future event - because from what I’ve seen, that event keeps getting pushed back as life inevitably changes.

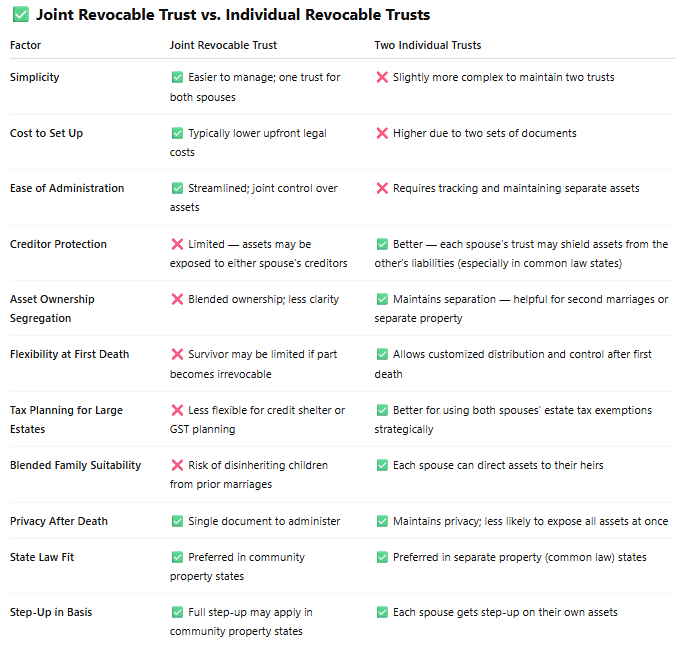

Here’s some consideration between joint vs individual trusts:

Some examples I’ve seen that create more of a clear answer for a joint trust making more sense are:

First marriages with the same estate planning goals (giving to kids, same charities, etc.)

You live in a community property state where the majority of assets have been acquired during marriage and/or majority of assets are already jointly owned.

Total estate is more simple - without various business interests, alternative private assets, private collections, and numerous real estate properties and generally well under the estate tax exemption limit of $13.99M in 2025.

General desire for simplicity and shared control.

Some examples I’ve seen that create more of a clear answer for an individual trust making more sense are:

Blended families or prior marriages.

While technically, you could create a joint trust where each spouse's assets are irrevocable upon passing - but the difference is how cleanly and succinctly that separation is implemented and maintained. A joint trust creates blurred lines - more specifically where emotions get involved.

Unequal estate or future inheritances.

Individual trusts create clear boundaries of whose assets are whose when there’s a desire to fully control how your assets are distributed upon passing.

You live in a common law state where one spouse holds more liability than the other.

Technically, in common law states a creditor can only pursue assets legally owned by the debtor. So if Spouse A is sued and Spouse B holds assets titled in their name (not jointly) then Spouse B’s assets are generally outside the scope of Spouse’s A creditors - because there is no legal ownership interest. The creation of an individual revocable trust marginally creates a stronger evidentiary trail of sole ownership and perceptually discourages creditor claims.

For example, if your spouse is a neurosurgeon, this high-risk profession creates an increased likelihood they’re sued so this may be a strategy you’d like to pursue even if marginally providing a benefit.

You’re a higher net worth individual ($10M+) and have a more complex estate.

This sets the stage for cleaner future estate planning strategies such as bypass trusts, generation skipping trusts, and spousal lifetime access trusts. Yes, you can do all this in a joint trust environment - but it’s cleaner to complete this via individual trusts where joint trust assets can get a little fuzzy.

Once a decision around a joint or individual trust is made, another important consideration is the funding of that trust.

Which brings me to a crucial point:

A trust is nothing more than a piece of paper if not funded.

This means deeding property into the name of the trust and updating brokerage and cash account tilting/beneficiaries to be in trust name.

In most cases, qualified retirement accounts (like IRAs or 401(k)s) should not name a revocable trust as the primary beneficiary.

When a trust becomes irrevocable upon death, any retirement assets paid into it are subject to accelerated distribution rules and may face taxation at compressed trust income tax brackets—reaching 37% on income over just $15,200 of income in 2025.

In contrast, naming individual beneficiaries typically allows for more favorable tax deferral and lower tax exposure.

Choosing between a joint or individual trust isn’t just about finding the “right” answer, but rather, about finding the right fit for your life, assets, and family dynamics.

What matters most is that you take action, stay flexible, and revisit your plan as life evolves.