Municipal Bonds, U.S. Treasuries, and International Bonds: How to Build a Balanced Fixed Income Portfolio

Many investors overestimate their upside & underestimate their downside.

Risk is rarely considered during positive markets & often regretted during negative markets.

Bonds are your tool in your investment allocation to weather periods of poor market returns but while many focus on increasing returns in equity markets, few discuss increasing returns in fixed income markets.

I recently came across a prospective client who owned 97.69% of their portfolio in both intermediate and long-term bonds - 62% of that exclusively in bonds that bond duration was longer than 10 years. The fixed income portfolio was 100% in municipal bonds and U.S. nominated bonds.

Why does this matter?

Longer dated bonds should offer higher expected returns for bearing a bond of longer maturity - but in practice, this hasn’t always been the case.

Academics have coined this the “Term Premium Puzzle”

Fama & Bliss in their 1987 paper, “The Information in Long-Maturity Forward Rates” showed that forward rates do contain information about future spot rates, but excess returns to long-term bonds are not reliably positive.

Today, there’s a growing body of research suggesting that long-term bonds don’t provide the returns for their level of risk.

This isn’t to say there’s not ever scenarios where owning long-term bonds don’t make sense, but rather, if your goal is to maximize returns per unit of risk, then long-term bonds may not be the best option.

Separately, I discussed the bond “sweet spot” in duration around 4-7 years.

Owning 100% municipal bonds can make sense when you’re an individual in the highest tax bracket.

Idea being - municipal bond interest isn’t taxed federally & is often state tax free when you buy in-state munis.

So the income you didn’t get taxed on acts as additional return to your yield.

Consider California - on top of a 37% federal tax bracket, you’d pay 3.8% net investment income tax plus 12.3% state tax (+1% for those over $1M in income), this would effective be a 54.1% tax rate.

So if your muni bond yield is 4%, this is effectively like having a bond yield of 8.7% - pretty nice.

In this individual’s case - they were retired & not in the 22% bracket.

Making 0 sense as to why this individual should be in municipal bonds.

In both theory & practice, due to the tax-exempt value of municipal bonds, issuers typically pay lower coupons than taxable bonds.

Additionally, as high-tax rate investors buy munis, this pushes up prices which decreases yield further.

So if you’re not someone who's in the highest tax bracket, muni’s likely don’t make sense for you (they surely didn’t for this individual).

Owning 100% U.S. nominated bonds can also make sense for many reasons.

Currency is extremely volatile - if your bonds are doing their job, they’re not fluctuating +/- 6% over short periods of time.

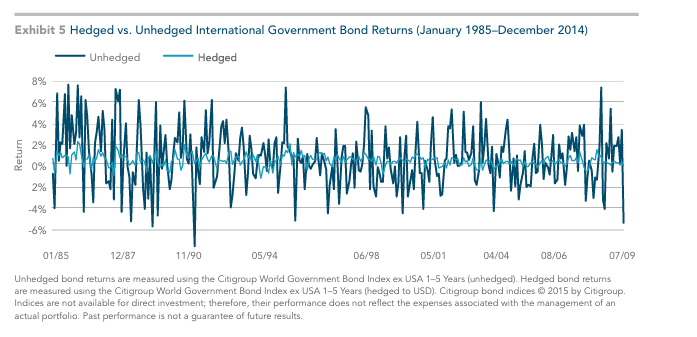

You can see the performance of unhedged (& hedged) bonds below:

Interest earned on U.S. treasuries is exempt from state and local tax - increasing their attractiveness to investors.

The U.S. bond market is also the largest and most liquid globally and widely considered a safe haven for many investors.

All making great reasons why investors overweight US bonds in fixed income portfolios.

That said, to exclude international bonds entirely, is to exclude both a diversifier and source of potentially higher long-term returns.

Over the last 12 years, intermediate term international bonds have outperformed U.S. bonds by 8.56%.

While it’s impossible to know how international bonds will perform looking forward - to exclude them entirely may hurt your total bond return.

Looking above, you can hedge international bonds and experience significantly less volatility while accessing international bonds.

A 20-30% allocation to international markets opens the door to new markets without compromising all the benefits of being a US centric investor.

The takeaway here is that being thoughtful around the construction of your fixed income can increase returns, reduce risk, reduce regret - all while being a ballast through rough markets.

For this prospective client, the lesson was clear:

By not being intentional with their bond allocation, they left 1.20%/yr on the table over the last decade.

Those gaps have now been corrected, ensuring their fixed income is finally working as it should.