Why Loading Up on Short-Term Bonds in an Inverted Yield Curve Could Hurt Your Returns

If the yield curve is inverted, should you just load up on short-term bonds because that’s the highest yielding component of the yield curve?

When it comes to fixed income investing, there’s three things to consider:

Your goals

Your tax rate

Your timeline for use of invested capital

For someone who has a goal to purchase a home in the next 18 months, it doesn’t make sense for them to own 30-year bonds.

Someone in this scenario, would be better served in shorter term bonds that the underlying maturity matches the timeline for when they need their invested capital.

Your goals and timeline for use of invested capital drive your asset allocation.

For someone who is in the highest marginal tax bracket, searching for the highest after-tax rate of return, municipal bonds may make sense for this individual.

The state, municipality, credit exposure, and duration of those underlying bonds would be determined by investors goals and timelines for use of invested capital.

That said, when I hear someone (who professionally provides financial advice) blankly say that because the yield curve is inverted all fixed income capital should be invested on the short-end of the curve…

I start questioning whether they’ve read past the first chapter of Bond Markets 101.

Over what timeline would cash-like assets outperform longer dated bonds?

How are you accounting for the day when the Fed cuts interest rates and the yield curve normalizes?

Do you think you’re just going to time the market perfectly and reallocate in longer-dated bonds?

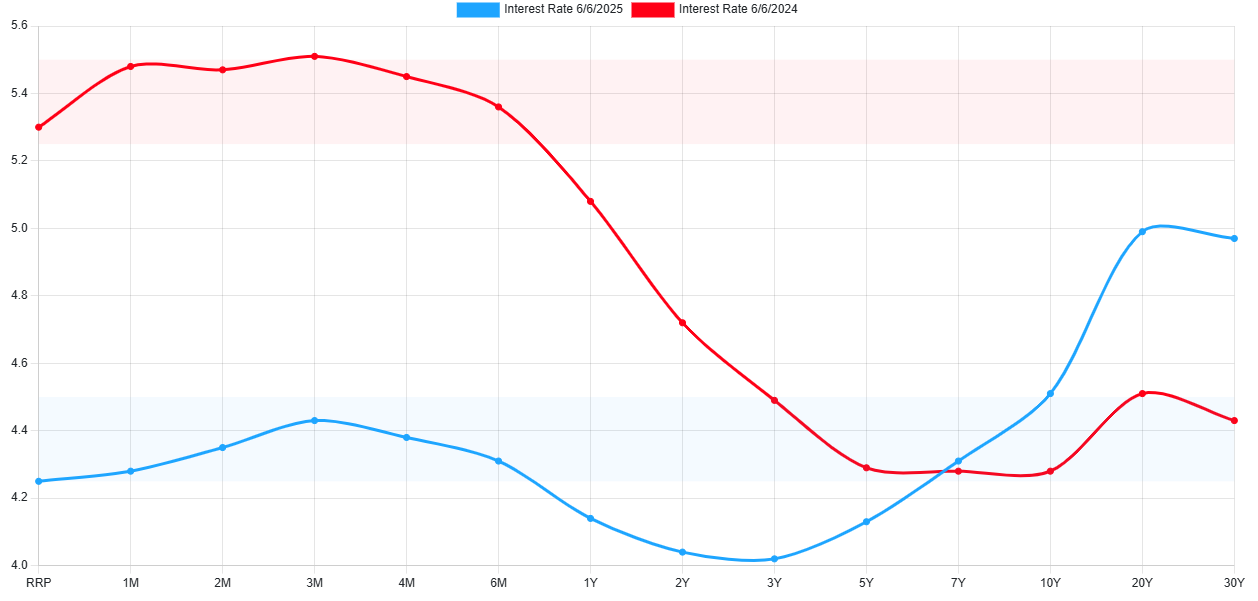

Not to mention - the yield curve is no longer inverted!

Focusing on short-term bond yields today, ignores the idea of total returns.

Total return includes both income and price appreciation.

When there’s changes in interest rates, bond prices adjust to reflect either a premium or discount from fair market value to remain competitive with other bonds and attract investor capital.

Short term bonds offer little appreciation when rates fall.

Longer term bonds offer greater appreciation when rates fall - increasing the likelihood of a higher total return.

Chasing yields on the low end of the curve can leave you disappointed if rates drop and the longer end of the curve increases in price.

Additionally, bond prices adjust continuously based on changes in market expectations of risk and future interest rates.

When the Federal Reserve increases or decreases rates - markets have already anticipated, and reflected, this expected change in prices today.

So to think you’re going to wait to see what the Fed does, then change your bond strategy… good luck.

Short-term bonds, by nature, mature quickly so you’re constantly reinvesting matured bond proceeds into newly issued short-term bonds.

The concern here lies when short-term yields decrease.

You face a shrinking income stream - not ideal for increasing your total return.

Not to mention that in an inverted yield curve, reinvesting maturing short term bonds forces you to roll down the yield curve - replacing matured bonds with lower-yielding bonds over time - this will also reduce your total return over time.

Owning bonds that are longer in duration act as shock absorbers in economic and market turmoil.

Reason being, in troubling economic times, interest rates tend to fall, to help stimulate the economy, which leads to higher price appreciation for investors in longer-duration bonds.

All this to say that - short-term bonds are not bad - they have their place in fixed income portfolios.

But the idea that 100% of your fixed income portfolio should be parked in short-term bonds just because the yield curve is inverted oversimplifies a far more nuanced decision.

I encourage you to think twice — and instead align your bond strategy with your specific goals, tax considerations, and time horizon to position for stronger total returns across market cycles.