The Equity Premium

If you’re questioning why, you should own bonds lately - you’re not alone.

Interest rates are at historical lows - owning a bond today yields significantly less than what it did in the past.

Many investors are flocking to equity markets in search of higher returns.

The reliability of a consistent and persistent higher expected future return for owning stocks compared to bonds is widely accepted.

For a long time, research has quantified this excess return of owning stocks over bonds to be ~4.32% per year.

Voila - the equity risk premium was born.

Investors are told to demand a premium for the additional risks of stocks compared to bonds.

Intuitively, this makes sense.

Volatility is the price investors pay for higher expected returns.

Not guaranteed but expected.

I don’t need to remind you that the sun will rise in the morning, it’s an absolute. Whether there is a full moon today, there is a probability.

In life there are very few certainties. Most everything operates within a spectrum - you’re better off working in percentages and probabilities, not absolutes.

As an investor, the question to ask yourself is how confident should you be over the long-term to expect a positive equity risk premium?

Eugene Fama and Kenneth French in their May 2018 research Volatility Lessons look to use historical market data to answer this exact question.

Their results are not what you might expect.

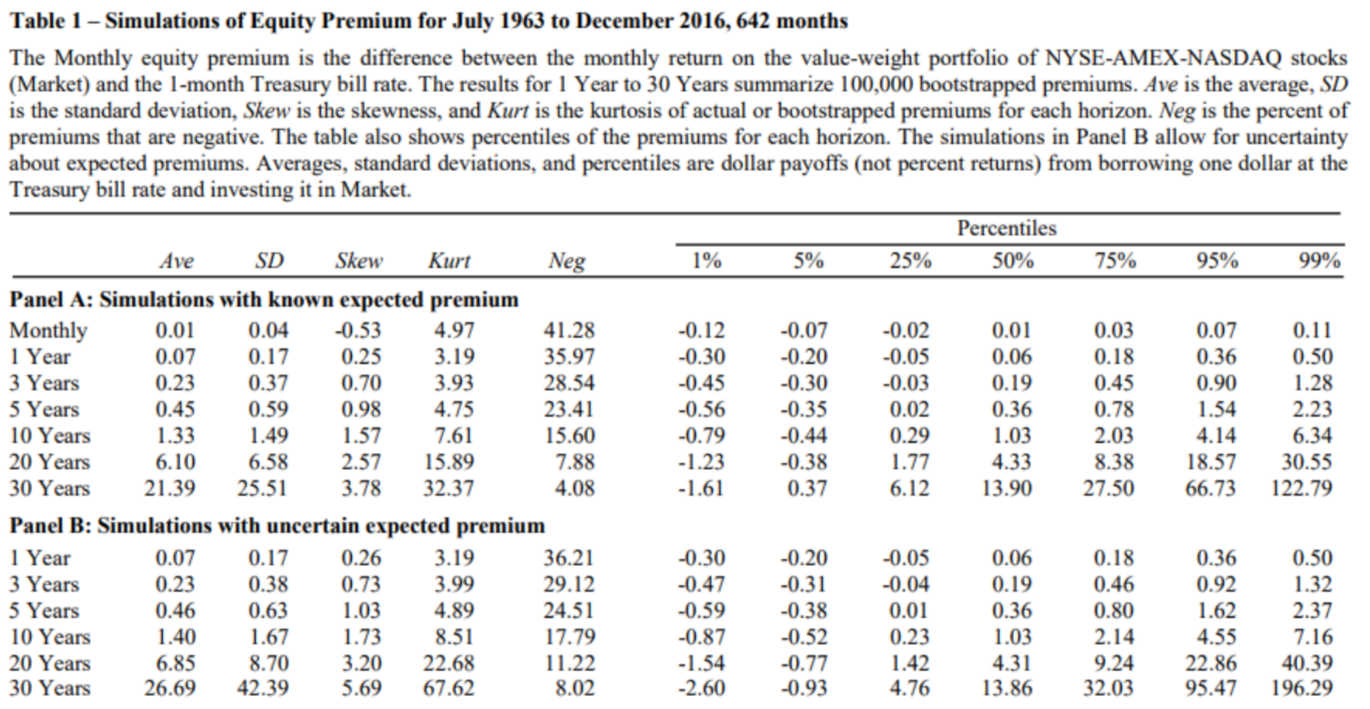

In conducting this research, they used monthly stock returns data from the Center for Research in Security Prices (CRSP) dating between 1963 until 2016.

They examined monthly, annual, three, five-, ten-, twenty-, and thirty-year stock premiums.

Essentially, they drew a ball out of a bucket. Each ball drawn out of the bucket represented one month and answered whether there was an equity premium that month - yes or no.

They did this 100,000 times for each time period to help increase statistical significance of the experiment.

Their results are below:

The likelihood of a negative equity premium is as follows:

1 month: 41.8%

1 year: 35.97%

3 years: 28.54%

5 years: 23.41%

10 years: 7.61%

20 years: 7.88%

30 years: 4.08%

What does this mean for investors?

Two things:

Longer time horizon = increased likelihood for a positive equity premium.

The equity premium is NOT guaranteed.

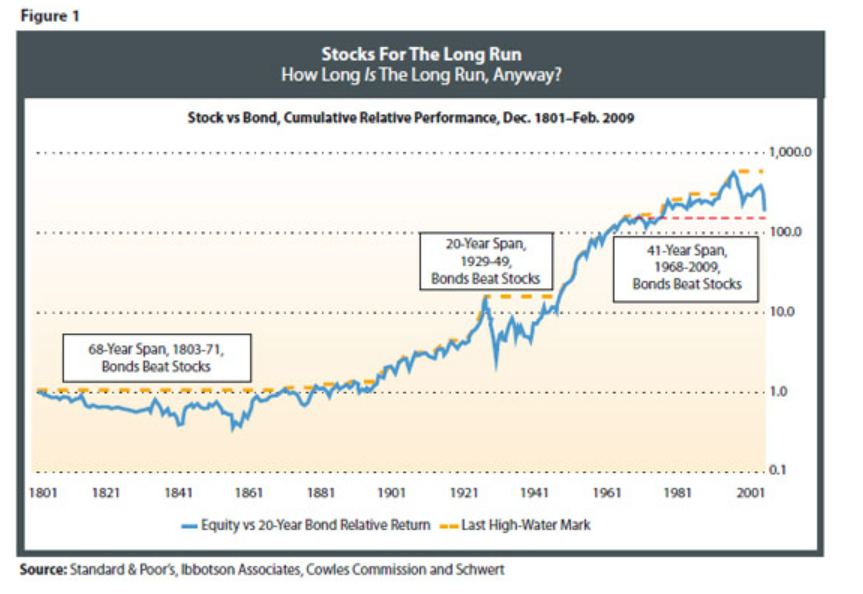

This isn’t all academic data mining. History has shown this to be true too.

Rob Arnott the founder and chairman of the board of Research Affiliates, a global asset manager in his article, Bonds: Why Bother, illustrates that long-term treasury bonds over meaningful periods of time (41-years in this case) have outperformed the US-equity market.

Shocking - I know.

You may be thinking that this time is different. Interest rates are lower than they were 20 years ago.

You’re right.

This time is different.

Just not different enough to matter.

We’re not entitled to always expected continued future price appreciation.

The companies today that are massively responsible for the growth of our economy have rightfully grown in size and price. The question to consider is how likely is the persistence of their returns?

Investors will flee at the first signs of weakening expected future cash flows.

The stock price will follow.

Disruptors get disrupted.

We live in an equity-focused world.

Front pages of major financial news outlets tout the razzle of the best large-cap US funds, small-cap value, international developed markets, etc. While bonds are left widely unnoticed.

The equity premium is real.

Investors should expect higher returns for owning stocks over bonds.

But don’t think bonds aren’t worth a second look within your portfolio.

Be wary of the hype of current market fads.

Stay disciplined - stay diversified.