How To Invest In Times Of Uncertainty

“Diversification may preserve wealth, but concentration builds wealth”

Warren is right… But he’s also wrong.

If you bought $10,000 of Apple stock in 1995, your annualized rate of return was 26.01% and would be worth $2,196,161 today.

By all measures - a fantastic investment.

Many investors who look to maximize returns through the use of individual stocks are disappointed.

Why?

Concentration may quickly build wealth but it also quickly destroys it.

1991 research from JP Morgan, The Agony & The Ecstasy: The Risks and Rewards of a Concentrated Stock Position:

Using the Russell 3000 since 1980, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value (this number is higher for Technology, Biotech, and Metals and Mining which had loss rates over 50%).

The median stock return since inception versus the Russell 3000 index was -54%.

Is the rare chance of picking the next Apple worth the cost of your investment success?

Looking under the hood of the S&P 500, the returns of the individual stocks that make up that index are highly skewed.

As an investor, the best way to protect against the risk of permanent loss of capital is through building a portfolio that combines these risky assets (which reduces total risk).

Your portfolio determines the majority of your current and expected future return.

This is outlined most famously in a 1986 paper from Gary Brinson, L. Randolph Hood, and Gilbert Beebower called Determinants of Portfolio Performance in the Financial Analysts Journal which revolutionized portfolio construction by emphasizing the importance of asset allocation (how you’re invested).

The study reviewed 91 pension funds from 1974 to 1983 and found that, on average:

93.6% of the total return variation was solely from asset allocation.

This places importance on:

What you hold over your skill to time the market or to pick stocks to generate market returns.

The optimal asset allocation will depend on your goals, time horizon, taxes, liquidity needs, and risk/return objectives.

The goal of your optimal asset allocation:

Construct a portfolio that gives you the highest return per unit of risk.

In practice, how do we achieve this?

Looking backwards, this is easy.

I can just look at which asset class performed the best & select the securities that generated the highest returns with the least amount of risk.

Looking forward, this is hard.

The difficulty is, no one knows which asset class will perform the best.

Therefore, we must build a portfolio that best captures our expectations of what future returns will look like.

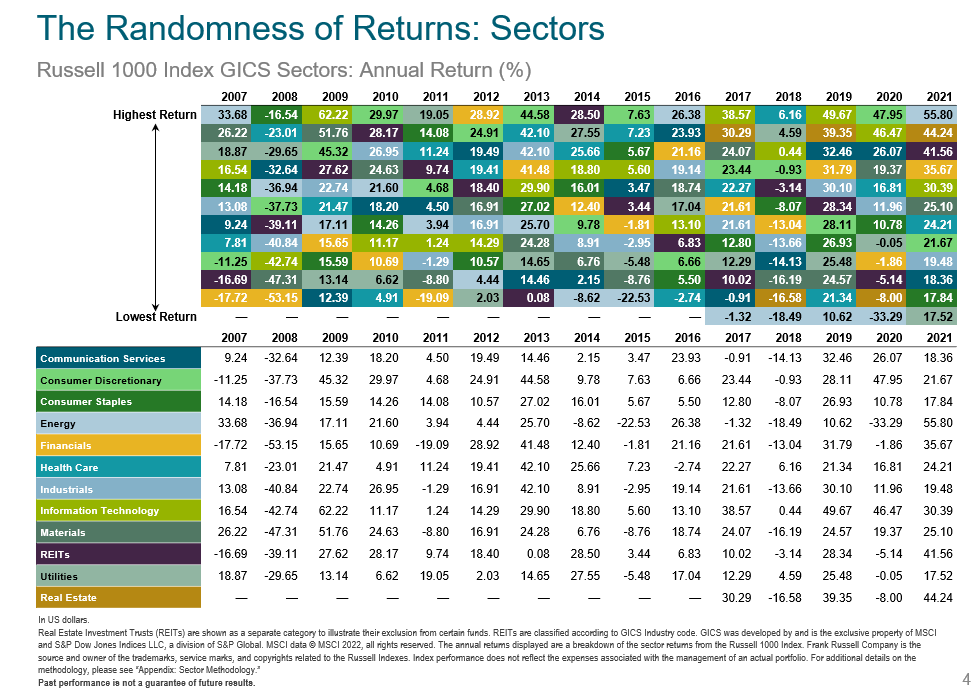

This is hard because what performs well this year may not perform well next year. History proves this to be correct.

Think large stocks will provide you the highest rate of return?

Think again.

Think the United States will always provide the highest rate of return?

Think again.

Think the technology sector will always provide the highest return?

Think again.

To combat the uncertainty of the market's future returns, the most successful investors diversify.

Diversification increases confidence and enhances your likelihood of long-term positive rates of return.

On average, a diversified asset allocation will increase expected return and have less risk.

In short:

Diversification is your friend.

How do you know if you’re diversified?

Your portfolio doesn’t all move in the same direction.

If this doesn’t make sense, consider the following:

Say you have $100 that earns 15% for two consecutive years or an investment that earns 29% then 1%.

Total return in both examples is 30%.

Portfolio A:

Year 1: $100 *1.15 = $115

Year 2: $115 * 1.15 = $132.25

Portfolio B:

Year 1: $100 * 1.29 = $129

Year 2: $129 * 1.01 = $130.29

Same total return with a difference of $1.96 in portfolio value.

Why?

Portfolio A was an individual stock.

Portfolio B was an index fund.

Moral of the story?

Diversify.

The most effective way to diversify is through weighting securities according to their market capitalization.

In english, that means:

If I’m looking to own a portfolio of stocks in the United States, then I own each stock according to its weight relative to the investable market.

If Apple stock makes up 5.71% of the total United States market, then I would own 5.71% of Apple stock in my portfolio of United States stocks.

The other 94.29% of my portfolio would own the remaining 3,962 publicly traded United States stocks in accordance to their weight relative to the whole.

In order for investors to not lose their mind trying to trade 3,962 stocks in their portfolio, they buy a fund that holds all these stocks by market cap.

One example of this would be Vanguard’s Total Market Index (VTI) which tracks this exactly.

Since we don’t know which stock, sector, region, or country will outperform in the future, starting with a global market cap weighted portfolio is a good starting point for a diversified portfolio.

Looking under the hood of an index fund that tracks the global stock market in one fund (VT), we see the following:

9,430 individual stocks

11 sectors

10 regions

51 countries

57% of stocks held in the United States

43% of stocks held internationally (split between developed & emerging markets)

Balanced stock style between growth and value

We diversify because we value consistency, reliability, and predictability in our investment outcome over inconsistent, unreliable, and speculation when building wealth.