Enhancing Retirement Spending Rules (over & above the 4% rule)

If your retirement goal is to both maximize your net worth & your total lifetime spending, is the 4% rule the best way to attain both outcomes?

Taking a step back - the 4% rule was a framework generated from research by financial planner William Bengen titled “Determining Withdrawal Rates Using Historical Data” in October of 1994.

Bengen looked at historical data from Ibbotson Associates Stocks, Bonds, Bills, and Inflation yearbook which provided monthly returns from US asset classes since January of 1926 and used historical simulations to determine the maximum withdrawal rate for each rolling period.

The highest sustainable withdrawal rate for the historical period was 4.15%, which was rounded down to 4% for simplicity sake.

Voilà - the 4% rule was created.

But what you’ll notice is that there’s plenty of other periods where a greater than 4% withdrawal rate was sustainable.

This opens the door for the idea of how flexible ongoing spending strategies may impact total portfolio spending.

This proved to be the true as later research from Jonathan Guyton titled “Decision Rules and portfolio management for Retirees: Is the safe initial withdrawal rate too safe” in 2004 and subsequently a later follow up article from William Klinger titled “Decision rules and maximum initial withdrawal rates” in 2006 was a response Bengen’s research.

Guyton and Klinger created a framework of spending guardrails, which they broke down into four steps:

Portfolio management rule: Depending on market conditions, where you pull your spending from can either enhance or damage your portfolio longevity. Idea being, when equity markets are performing well, pull from stocks. When equities are performing poorly, bonds are more stable, so pull from bonds because they’re performing better.

Withdrawal Rule: Increase spending by inflation except in years where the portfolio experienced a negative return.

Capital preservation rule: Spending is cut 10% if the current withdrawal rate rises 20% more than its initial level and the planning age is still more than 15 years away. Ex: if your spending initially is 4.50%, then a spending cut would take place once your withdrawal rate reaches 5.40% and you’re in the first 15 years of retirement.

Prosperity Rule: Spending is increased 10% in any year that the current withdrawal rate falls to 20% below its initial level (inverse of capital preservation rule).

Idea being - yes, you can get more out of your portfolio with a flexible approach.

But in practice, this is typically done through looking at your financial picture holistically combined with monte carlo simulations to determine financial probabilities of success.

A monte carlo simulation runs 1,000 market scenarios based on the assumptions in the model to determine a probability of success percentage.

If 830/1000 scenarios had $1 or more left at the end of the plan, then your success rate was 83%.

Not bad.

Your asset allocation, market’s expected (& realized returns), inflation, longevity, sequence of returns risk, future medical costs, fixed streams of income, and liquid & illiquid assets, all play into the bigger picture for determining withdrawal rates.

In practice spending guardrails could look something like as follows:

Solving for a 90% probability of success, if probability of success grows over 95%, you increase spending back down to 90% probability of success.

If probability of success falls to 70% or less, decrease spending back to maintain a 90% probability of success.

Using numbers, with a $10,000/mo base spending on a $2,400,000 portfolio combined with other guaranteed income sources:

If total portfolio value grows to $2.64M, increase portfolio spending to $10,556/mo.

If total portfolio value falls to $1.68M, decrease spending to $9,445/mo.

When working with clients with spending guardrails, I like to have a conversation around the kind of income experience they’re looking for in retirement.

For some, having more constant income is more important than trying to stretch their total portfolio with a more flexible spending approach.

There’s never a right answer, just the answer that works best for who I’m working with (of course, I’ll have an opinion, but if the given variation in spending isn’t something a client is comfortable with - we go back to the drawing board).

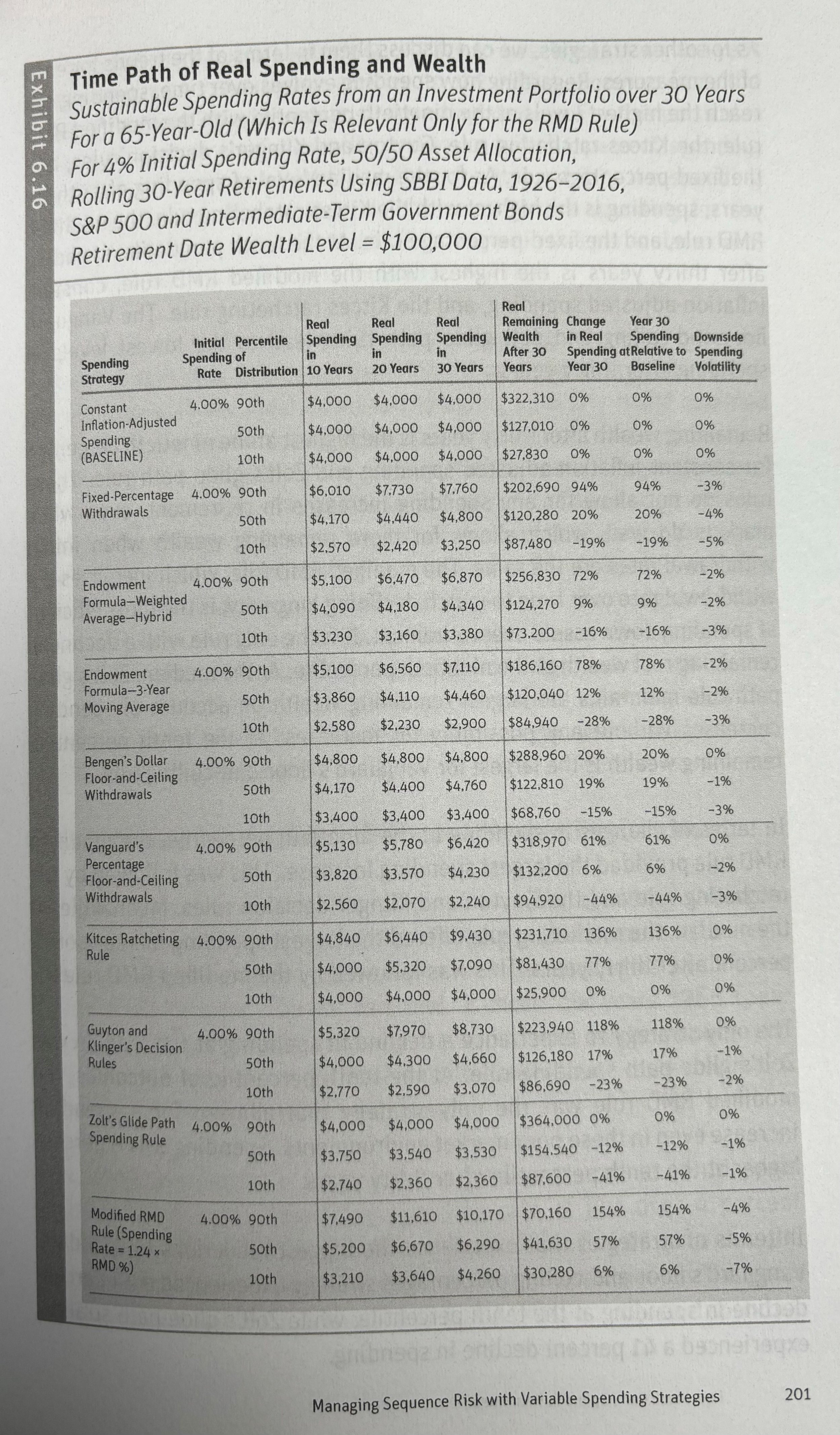

The exhibit above is from Wade Pfau’s book - “The retirement researcher’s guide series - How much can I spend in retirement - A guide to investment-based retirement income strategies” and illustrates who various spending strategies can enhance the increase in spending over retirement.

Guyton and Klinger’s spending rules allowed for 17% increased spending in the 50th percentile.

Above all - one of the most important components of a retirement plan is that it keeps up with the pace of change over time.

Market conditions, taxes, spending, inflation, health, are different today then they were 10 years ago and those factors impact your plan.

As new information is being presented, your plan should incorporate these changes to optimize spending in your favor over time.

The difference could mean thousands of dollars in additional monthly spending.